CHICAGO – May 3, 2022 – The Financial Solutions Lab, an initiative launched and managed by the Financial Health Network in collaboration with founding partner JPMorgan Chase & Co. and with support from Prudential Financial, today announced that it has selected six organizations for its 2022 Accelerator program which is focused on financial benefits and tools. The companies selected for this year’s cohort are Canary, finEQUITY, Let’s Get Set, Pie for Providers, Stackwell, and Sunny Day Fund.

The 2022 cohort was selected for their potential to help individuals better navigate benefits offerings and financial tools that strengthen financial health. In particular, the offerings from this year’s cohort assist consumers with workplace benefits, wealth and credit building, and public systems navigation.

The 2022 cohort companies by area of focus are:

Workplace Benefits:

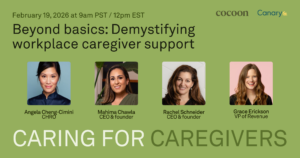

- Canary (New York, NY) partners with employers to ensure that in times of financial need, their employees can access emergency aid swiftly and with dignity.

- Sunny Day Fund (Falls Church, VA) partners with employers to provide their employees an easy, accessible, and rewarding path to save for emergencies and future life events.

Wealth and Credit Building:

- finEQUITY (Brooklyn, NY) helps build credit profiles for individuals reentering society after being incarcerated.

- Stackwell (Boston, MA) delivers automated financial tools and education through a digital investment platform to help people in the Black community stack and build wealth.

Public Systems Navigation:

- Let’s Get Set (San Francisco, CA) supports hardworking parents and families to secure and deploy their maximum tax benefits and create a path to enhanced financial stability.

- Pie for Providers (Chicago, IL) streamlines and automates government funding for child care providers, increasing providers’ incomes and helping families access affordable care.

“Public benefits help thousands across our country improve their financial health, and yet, systemic barriers still prevent many from taking full advantage of them,” said Adeeb Mahmud, chief program officer, Financial Health Network. “We are proud to collaborate with this year’s cohort of innovators to drive innovation in the financial health marketplace, breaking down these historic barriers.”

The 2021 Financial Health Pulse U.S. Trends Report reveals that two-thirds of Americans are still not Financially Healthy, and stark disparities remain across gender, race/ethnicity, and income. While government programs reached those in need, recipients may be at risk as these policies expire. Specifically, the 2022 cohort companies are focused on strengthening financial resilience by improving safety nets for low- to moderate-income (LMI), Black, and Latinx individuals – many of whom may face systemic barriers preventing access to key benefits and financial tools, limiting their opportunities to improve financial health.

According to the JPMorgan Chase Institute, public supports such as stimulus payments and child tax credits had a positive immediate impact on liquidity for LMI, Black, and Latinx communities, but systemic barriers continue to prevent these communities from building and maintaining long-term financial health.

“Financial resilience remains a top priority in our effort to improve financial health,” said Sarah Keh, vice president, Prudential Inclusive Solutions. “The cohort of fintechs selected for this year’s program will mean more inclusive products for underserved communities, a covenant of Prudential’s goal to put financial security within reach for everyone. We look forward to engaging with these innovators to scale their purpose-driven organizations and support financially vulnerable communities.”

For nearly a decade, the Accelerator has annually invested and supported a cohort of companies, working directly with entrepreneurs to further our mission of identifying, developing, and scaling fintech solutions for LMI individuals and Black and Latinx communities. Each selected organization will receive $100,000 from the Financial Health Network; behavioral insights to help inform product development and market strategy; guidance to navigate the legal and regulatory fintech environment; insights on impact and customer financial health measurement; resources for external marketing and communications; mentorship from financial services and financial health experts; support to further diversity, equity, and inclusion; and peer learning via virtual retreats and working sessions throughout the year.

About the Financial Solutions Lab

The Financial Solutions Lab was established in 2014 to cultivate, support, and scale innovative ideas that help improve financial health. FSL focuses on solutions addressing acute and persistent financial health challenges faced by low- to moderate-income (LMI) individuals, Black and Latinx communities, and other underserved consumers. The Financial Health Network manages the Financial Solutions Lab in collaboration with founding partner JPMorgan Chase & Co. and with support from Prudential Financial. The programs the Financial Solutions Lab offers to execute on this mission include the Accelerator, one of the few fintech accelerators focused on financial health; the Exchange, a meeting place for interested nonprofit and fintech providers to explore collaboration and swap insights on how to build high-impact partnerships; and the Collaborative, which explores how innovations in policy can complement private and nonprofit financial health solutions. For more information, visit https://finlab.finhealthnetwork.org/.