Despite the rise of employee financial wellness programs, many miss a crucial gap: they don’t address the immediate financial crises that nearly half of workers face daily – affording basic living expenses. Common solutions, like savings plans or financial education, are important but can feel out of reach for many employees facing immediate crises. Meanwhile, we all know that finances are the biggest stressors for employees, distracting them at work, and costing businesses a lot of money. Approaching year end, it has become a business-critical issue for leaders to identify and plug the gap in employee well-being offerings.

SEE THE COMPANIES THAT HAVE CHOSEN TO INVEST IN GRANT CIRCLE, CANARY’S EMPLOYEE RELIEF SOLUTION

The Financial Reality of Employees

Your employees’ financial lives are incredibly complex. The fact that nearly half of employees struggle to afford daily expenses is only part of the picture. For example:

-Nearly half of American families cannot afford a $400 emergency expense without borrowing or selling something;

-56% of employees say personal finances are their biggest stressor;

-21% of employees cite the affordability of essentials (or lack thereof) as their biggest challenge.

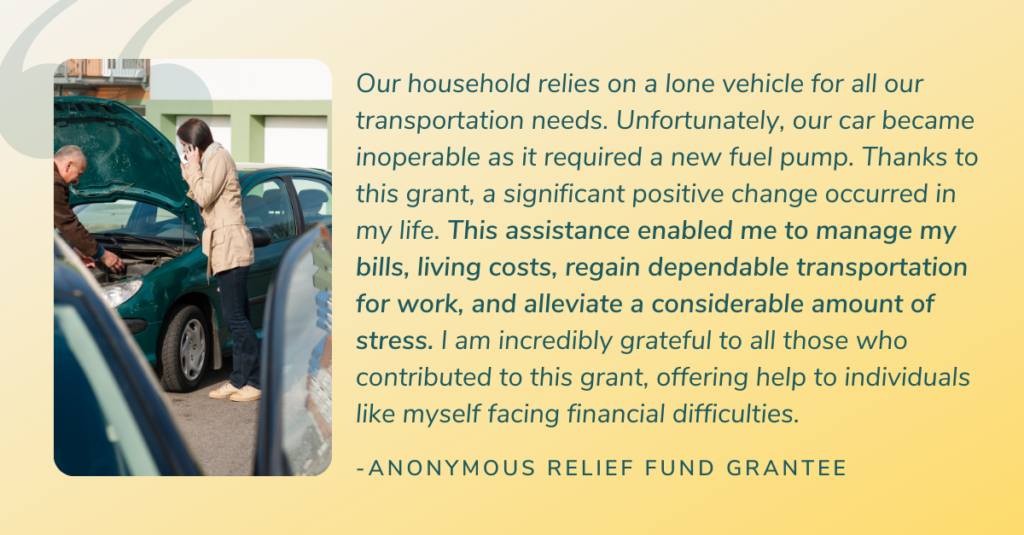

Knowing this, the question for leaders is clear: Why not address the biggest financial challenge facing nearly a quarter of your workforce? It’s often easier to see the true impact of investing in this work with a personal story, so we’ve outlined an all-too-common issue facing grantees:

Imagine an employee already stretched thin with gas, grocery, and childcare bills. One day, on their way to work, their car breaks down and sends them to a car repair shop instead of work. For many, the consequences are immediate. This financial curveball could mean missed shifts (and paychecks) and impossible choices between rent payment or car repair. It’s hard to imagine how a person can make that choice. But many are making just that choice or other really difficult tradeoffs. For employers, the ripple effects are just as serious: higher absenteeism, lower productivity, and reduced engagement.

The Disconnect in Employee Financial Wellness Programs: Missing the Immediate Need

The same PNC survey highlighting 21% of employees struggle to afford basic living expenses shared that 1 in 4 employers and workers believe more benefits can enhance a person’s financial security. PNC elaborates that new, innovative approaches, like savings, early wage access, financial planning/education, or student loan repayment, are the way to help. While very true, these solutions are missing a big piece of the picture. Employees don’t have extra income to save when every dollar is already stretched, making these programs feel inaccessible. Helping workers navigate immediate financial stressors can get them to a place where these long-term financial well-being resources become more helpful.

At Canary, we firmly believe that companies must adopt a portfolio approach to offerings to improve employee well-being. By introducing near-term financial relief solutions, like Canary’s Grant Circle, into employee financial wellness programs already offering long-term financial tools, companies more completely address the true scope of financial issues facing their employees today.

The Canary in the Coal Mine: Addressing Financial Issues Before They Escalate

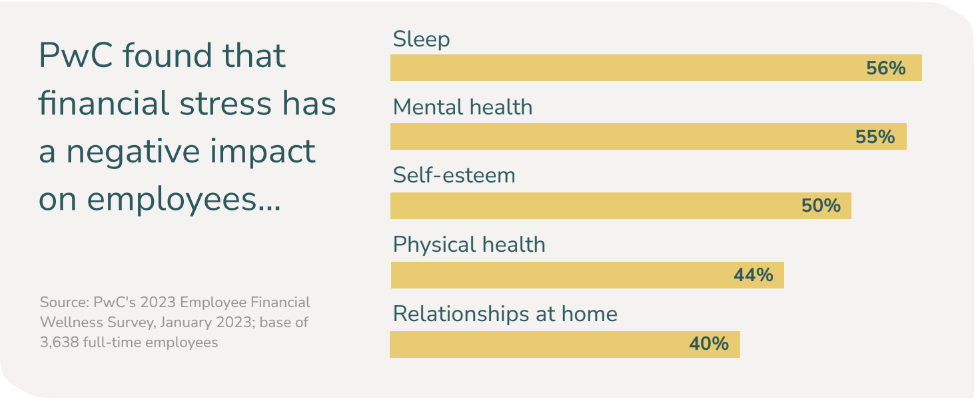

When employees are overwhelmed by financial strain, it affects more than just their financial well-being. Employee financial stress significantly impacts other areas, like mental health, sleep, self-esteem, physical health, and personal relationships. Knowing that it’s really no wonder that the same financial stress follows them to work, affecting their engagement and productivity.

Just as the “canary in the coal mine” once warned miners of imminent danger, Canary’s employee relief funds serve as an early warning system for modern-day workers, offering financial protection before problems spiral out of control. These funds provide quick, anonymous support in moments of crisis — a medical emergency or an unexpected car repair — allowing employees to stabilize before stress escalates into larger challenges like debt or eviction. Canary leverages cutting-edge technology and payment innovations to tap into something timeless: the human instinct to help one another.

The benefits of Grant Circle, Canary’s employee relief fund

- Confidentiality: 3rd party application and grant management services guarantee employee anonymity. HR teams and leadership never need to know who needs help or why.

- Ease of use: Canary’s streamlined 8-step application process limits the cognitive load for employees who are already stressed.

- Fast relief: Each applicant, approved or not, receives compassionate communication from grant managers within two business days, if not faster, and approved grantees receive non-taxable emergency cash payments within 48 hours.

- Flexible program design: Canary’s team will guide a company’s Grant Circle design based on best practice recommendations while considering their unique employee composition to develop a program that works for each client.

For people leaders, the impact of employee relief funds goes beyond providing financial aid. When employees are no longer consumed by the anxiety of covering an unexpected expense, they can more fully engage at work and plan their financial futures with a clearer mind. This translates to improved retention, morale, and a more engaged company workforce. Beyond immediate financial support, Canary provides anonymized data and regular impact reporting to reveal underlying workplace trends. This allows companies to identify and address broader issues that might contribute to employee financial stress. Near-term financial help enables employers to create a safer, more supportive environment where employees can thrive.

The Business Case for Employee Relief Funds

Employee relief funds are more than just a compassionate gesture — they are a smart business investment. When financial stress is a leading cause of distraction and lost productivity in today’s workplace, offering equitable access to financial support is a necessary and cost-effective way to address employees’ immediate financial challenges. With an average grant amount across Canary’s programs of just under $1,000, charitable grants provide fast relief at a fraction of the cost companies might spend on other retention efforts, recruitment and training to replace employees who quit due to financial stress or lost productivity. Beyond the numbers, relief funds send a powerful message that the company genuinely cares about its workforce. This culture of support, especially valued by Gen Z and Millennials (soon to be the largest segment of the employee population), fosters loyalty and engagement, creating an environment where employees feel seen and valued, making them more likely to stay. This approach saves on costly retention and productivity losses while building a workforce that feels supported and valued — critical for long-term success.

Rethinking Financial Wellness for 2025 and Beyond

As companies navigate the 2025 planning and budget season, it makes sense for leaders to reassess their current employee financial wellness strategy, evaluate what key supports might be missing, and how to fill the gaps going forward. Employee relief funds bridge that gap by providing fast, meaningful assistance when it’s needed most. In a time when employees increasingly expect employers to be values-driven, relief funds offer a unique opportunity to make the work community a central part of a company’s social impact. Given your employees’ financial challenges, the solution is clear: they need help now. Ignoring this could lead to lost productivity, disengagement, and turnover, which can cost far more than stepping in with charitable relief. Quite simply, companies can’t afford to wait.

Contact our team today to learn more about supporting your employees through financial hardships. In the meantime, download our most recent Impact Report to learn how employee relief funds support modern, diverse workforces in uncertain times.