Despite headlines of an economic uptick and job growth, financial instability remains a defining element of people’s lives. It’s stretching household budgets to their breaking point and the stress of it all continues to bleed into the workplace. The stakes couldn’t be higher for employers: financial stress is the top cause of workplace burnout, absenteeism, and turnover At Canary, this isn’t simply the national narrative — we see it reflected in the increased adoption and usage rates of our employer-sponsored emergency relief programs. The data is clear: emergency relief funds are now essential for driving meaningful changes to employees’ financial well-being (or lack thereof).

A National Picture of Financial Stress in the Workplace

By now, we all know that nearly two-thirds of Americans live paycheck to paycheck and 44% of households can’t cover a $400 emergency without borrowing or selling something. To top it off, we also know that 42% of employees struggle to afford basic essentials each month. These aren’t just headlines — it’s a reality mirrored in our own data from Grant Circle, an emergency relief fund powered by Canary (more on that in the next section).

This reality doesn’t stay at home and follows individuals to work. According to PwC, financially stressed employees are five times more likely to be distracted, less productive, and twice as likely to seek a new job than their non-stressed colleagues. With $250 billion in lost productivity each year, the cost of workplace financial stress is too high to ignore. Tackling an undeniable root cause — financial instability — is central to the solution.

What Our Emergency Relief Fund Data Tells Us

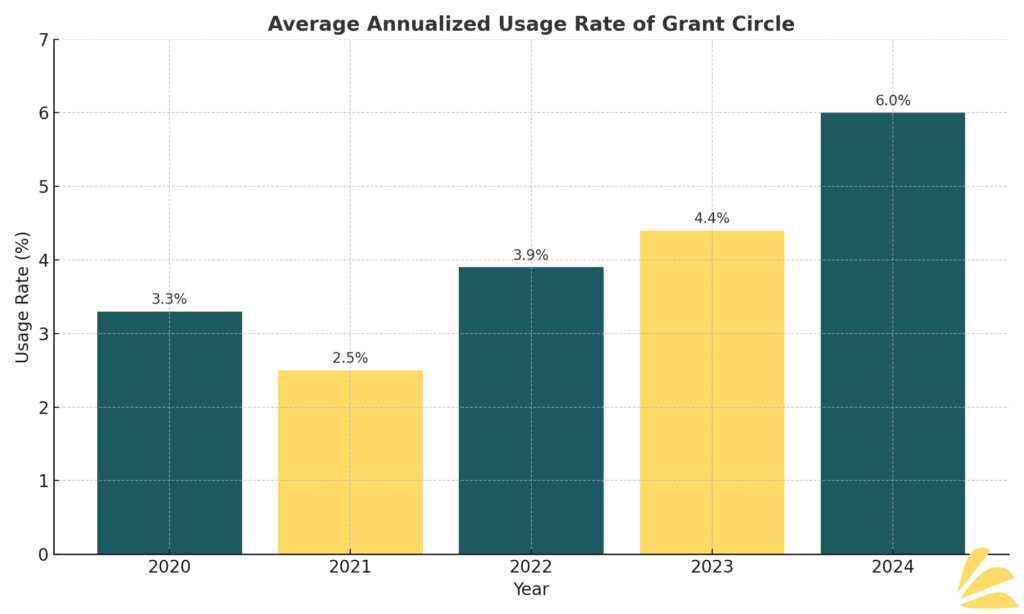

At Canary, the usage of our employer-sponsored emergency relief fund programs has risen steadily over the past five years. In 2020, about 3.3% of employees accessed these funds. At the end of 2024, that number has jumped to 6% — a nearly 82% increase.

But it’s not just program usage that helps us understand the scale of need on our hands. Simultaneously, we have seen:

- The total amount of money granted through our programs nearly doubled from 2023 to 2024;

- Over that same time period, our client base expanded by 38%;

- By proxy of client growth, the number of individuals covered by Grant Circle programs grew by 31%.

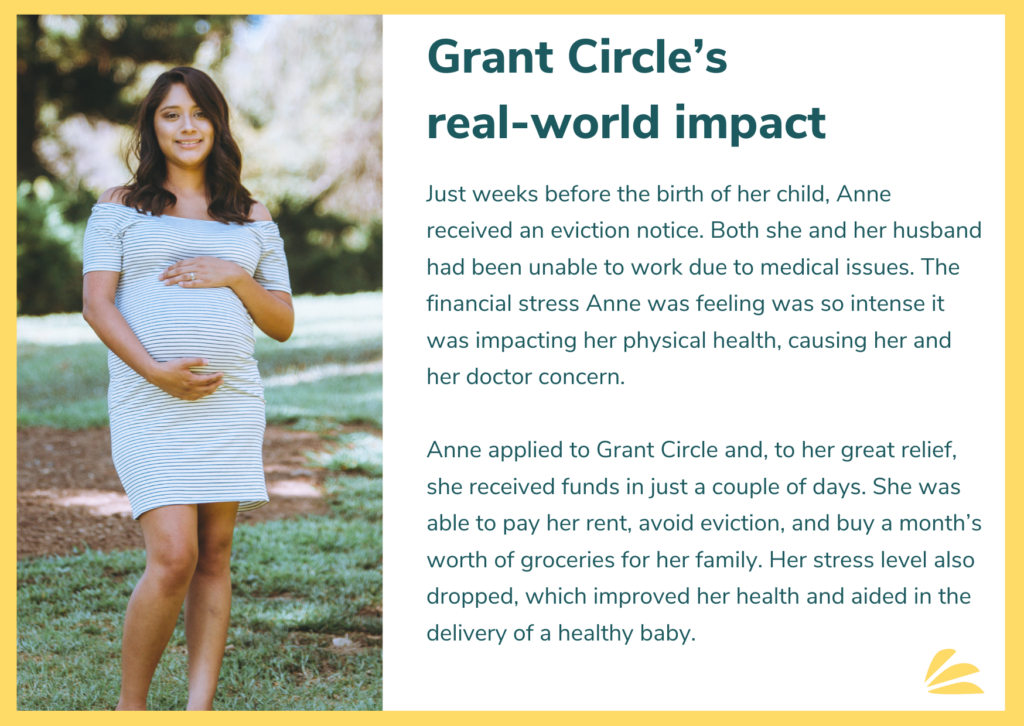

Each of these numbers represents making a meaningful difference in the lives real people navigating financial hardships. Behind every number is a story of:

- a parent covering unexpected childcare costs when schools close;

- an employee waiting on car repairs to make it to work;

- a family weathering the financial strain of a medical emergency not covered by insurance.

While these numbers are sobering, they’re also a sign of hope. They show that employers are increasingly stepping up to meet the moment to help their most important asset – their people – when they need it most.

The Business Case for Emergency Relief Funds in Your Work Community

For too long, emergency relief programs have been seen as a “nice perk” rather than an essential part of employee support. But the trends we see nationally and in our own programs tell a different story. Financial stress is a workplace issue, and employers who ignore it risk:

- Increased absenteeism: Employees dealing with financial stress are more likely to take time off.

- Higher turnover: Workers who feel unsupported are more likely to leave for a more empathetic employer.

- Lower productivity: Financial stress leads to distraction, disengagement, and burnout.

On the flip side, investing in emergency relief funds offers tangible benefits:

- Stronger loyalty and trust: Employees who receive support during tough times feel valued.

- Better workplace culture: Financial support fosters a sense of security and well-being.

- Improved productivity: Workers who aren’t worried about making ends meet can focus on their jobs.

Emergency Relief Funds: A Workplace Essential in 2025

As we look ahead to the New Year, one thing is clear: the time for employers to act is now. Emergency relief programs are no longer just a compassionate choice, they are a strategic imperative. Organizations that prioritize employee financial wellness create healthier, more resilient teams. By addressing immediate needs through relief funds and integrating them into a larger financial wellness strategy, employers can meet their people where they are — and help them build a more secure future.

Financial stress is an urgent issue and, luckily, it’s one employers can address head-on quickly and cost effectively. By offering emergency relief funds, you don’t just support employees through tough times; you build trust, loyalty, and a stronger workplace for the future. Our data also shows that these programs work. And in today’s challenging economic landscape, they’re more vital than ever.

Ready to support your employees and create a stronger workplace? Contact us today to learn how Canary’s emergency relief programs can make a difference.

At Canary, we’re proud to partner with forward-thinking employers who recognize the power of emergency relief fund programs. Together, we’ve helped thousands of employees navigate financial crises and regain stability.

Want to learn more? Learn how how our programs are making a difference for other organizations:

- Click to watch From Breweries to Bogs: How Boston Beer & Ocean Spray Address Employee Financial Stress

- Click to read Canary + Arosa: Prioritizing the financial well-being of care professionals through people-centered innovation

- Click to download last year’s Impact Report, Transforming Workplace Well-Being Through Emergency Financial Support