For two decades, SAMHSA has designated May as Mental Health Awareness Month to underscore mental health’s significance in our overall well-being. While conversations about the correlation between financial strain and mental wellness are prevalent, they tend to emphasize individual responsibility. But amid the most stressful financial events — unexpected hardships — many people cannot fully recover on their own. Better planning, saving, or de-stressing through exercise or meditation can’t replace the security of savings, support from friends and family, or investments. The trauma of unexpected financial hardships, coupled with little to no security net, can cause employee financial stress and mental health to spiral. Employers focused on improving the mental health of their teams must acknowledge the role finances can play in it. Once they do, people-centric teams can identify how to be there financially for employees at their lowest points, preventing the cascading impact they can have on their mental health.

Financial Stress is a Big Hit to Employee Mental Health

Most workplaces are actively working better to recognize the signs of poor mental health among employees and invest in the right resources to help. Today’s worker wants an employer to care about their holistic well-being, and figuring out how to support improved mental health is a necessary, nuanced part of the puzzle. Offering access to mental health resources, meditation apps, or group mental health coverage is undoubtedly a piece of the big picture. But, below the surface, other seemingly disparate issues contribute to an individual’s declining mental health. Identifying the root causes and investing in programs that solve those issues is just as crucial as offering easy-to-access, company-sponsored mental health resources.

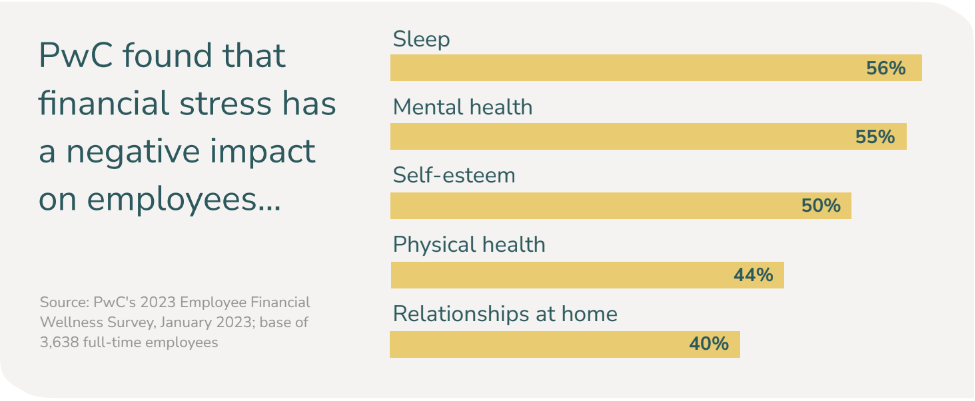

One of those root causes is a parallel decline in their financial health. The height of the COVID-19 pandemic dramatically raised awareness for the complex financial lives of many Americans. Since then, people’s finances have not seemed to improve. In fact, with 62% of Americans living paycheck to paycheck and the increasing pressures of inflation and cost of living increases, the financial outlook for many has gotten worse. And it’s impacting employees everywhere. According to PwC, 57% of employees report that finances are their most significant source of stress. While stress itself is not a mental illness, frequent or intense stress can create or exacerbate mental health conditions like anxiety, depression, or substance abuse.

How the Financial-Mental Health Connection Manifests Itself in the Workplace

The same PwC study cited above shows that 55% of employees report that financial stress has a direct impact on their mental health. But looking at the other ways this stress shows up is interesting. The different effects reported influence mental health, too. Poor sleep, self-esteem, physical health, and relationships can all contribute to worsened mental health.

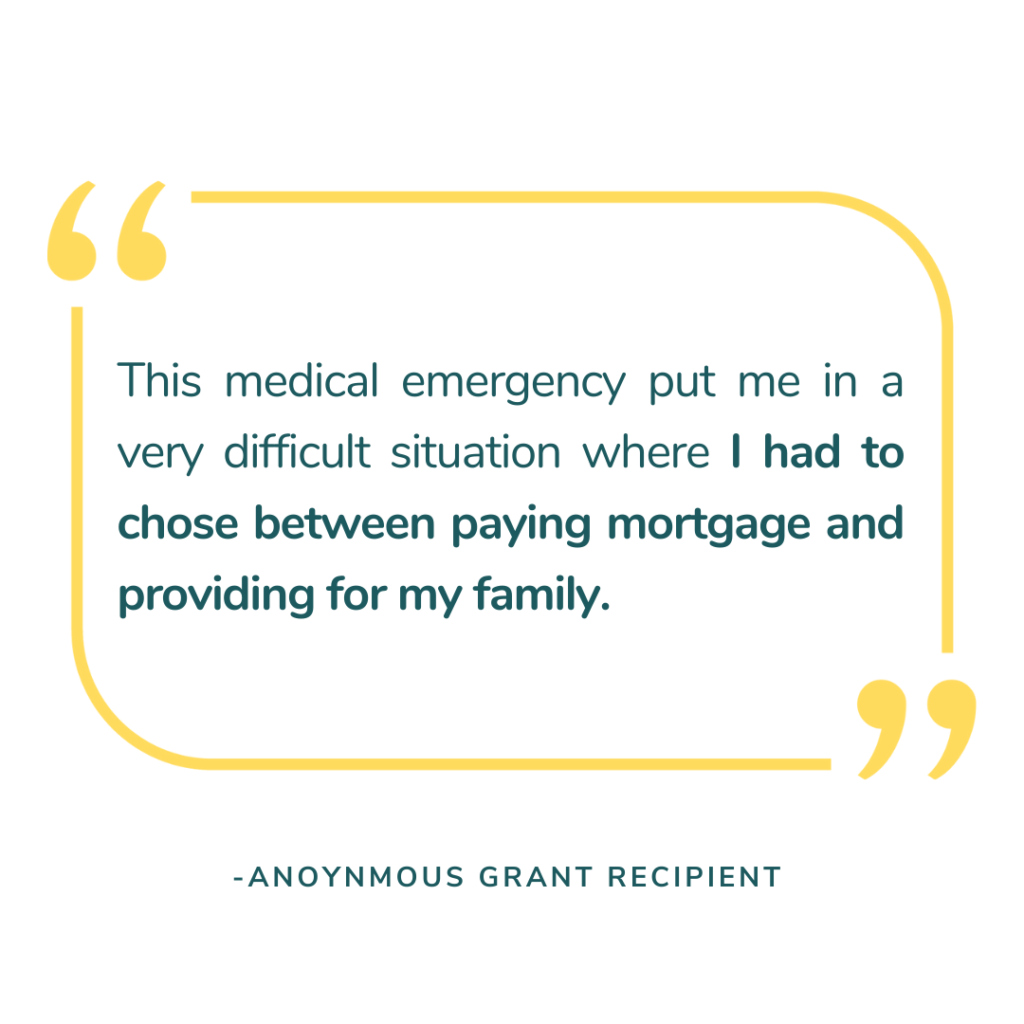

At Canary, we hear the stories of financially stressed employees every day. We often encounter employees at very low points and the details of their situation are heartbreaking. Reading these stories, it’s not hard to draw the connection between financial issues and their influence on one’s mental health. Tradeoffs in the face of financial hardship are often the most emotional, stressful ones to make. Workers applying through Grant Circle, our employee relief solution, usually need emergency cash to afford the essentials, like housing, food, and utilities. This is supported by external data, too. 49% of employees find it difficult to meet household expenses on time each month. Take, for instance, the mother who lost shifts at work to take care of kids who were home sick but didn’t know how she would put food on the table that week without a full paycheck. Or the retail worker whose car broke down and couldn’t get to work until it was fixed – should they prioritize the mechanic bill or rent that week?

Furthermore, the stigma surrounding financial difficulties can exacerbate the mental health impact, leading individuals to suffer in silence rather than seek support. At Canary, we understand the importance of creating a supportive environment where employees feel comfortable addressing their financial concerns without fear of judgment.

Work community can alleviate employee financial stress & improve mental health in the process

When times get tough, community often rises to support each other. Consider mutual aid projects, GoFundMe’s, or school fundraisers — they rely on the power of community to raise resources for people and causes they believe in. Considering the average person spends 1/3 of their life at work, it only makes sense that the workplace be a source of community support, part of a person’s safety net, in difficult times. Additionally, an increasingly young workforce believes companies are responsible for caring about their financial well-being, and they are willing to leave a company to find better benefits elsewhere.

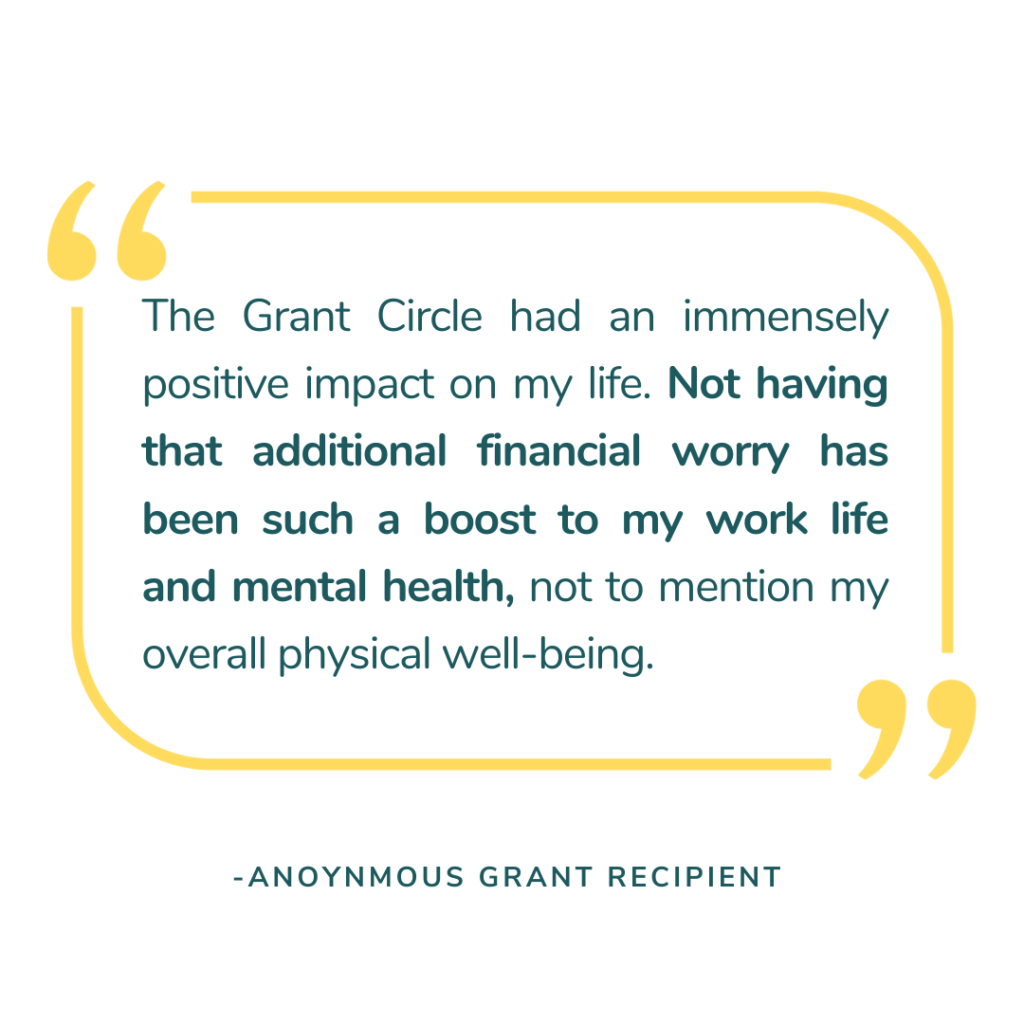

I have said this before, but it bears repeating: taking care of employees’ financial well-being doesn’t just make good people sense; it makes even better business sense. How, you ask? Consider the statistics around employee productivity (or lack thereof) when someone is stressed and what that productivity problem costs employers. Financially stressed employees spend 9+ work hours/week dealing with their finances, costing employers $4.7B weekly. Employers have a tremendous (not to mention low-cost) opportunity to solve part a large part of the problem: offer emergency payments to employees in crisis. Donating a relatively small amount of money in the face of a true emergency can break negative cycles and get employees back in a good headspace.

As Mental Health Awareness Month reminds us, now is the time to reevaluate workplace approaches to well-being and ensure the interconnected nature of mental and financial health is addressed. Paramount to supporting the mental well-being of your workforce, is assessing the underlying symptoms of employee stress and developing a robust set of preventative resources. When finances rank as a top stressor for 55% of employees, workplaces must recognize the pivotal role finances can play in one’s mental health. By embracing an empathetic culture of support and understanding, companies can meet employees where they are with solutions that move the needle and empower them to thrive personally and professionally.

Ready to learn how your organization can invest in employee financial well-being?

Reach out to our team today to learn about supporting employees through financial hardships. In the meantime, download our most recent Impact Report to learn how employee relief funds support modern, diverse workforces in uncertain times.