This feature was written by Adam DeRose and originally appeared in HR Brew’s Starting Up series on September 5, 204.

Rachel Schneider is a former researcher at the Financial Health Network and the Aspen Institute. She studied the financial lives of working Americans and coauthored a book on the topic: The Financial Diaries: How American Families Cope in a World of Uncertainty.

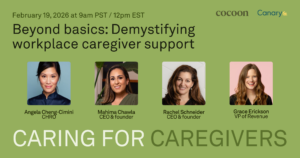

Schneider is also the founder of Canary, a third-party employee relief platform aiming to provide companies with a way to make a greater impact on the financial lives of their employees.

With $3.25 million in funding from Capital One Ventures, Propel, Marguerite Casey Foundation, and Restive Ventures, Canary offers employees an anonymous, employer-sponsored place to request financial aid when they’re in need. A company’s portal is branded with company assets and requires only a handful of steps to request financial help. Canary’s team evaluates the request based on IRS-criteria and grants those who qualify the funds to meet their needs.

A $2,500 problem. In her research, Schneider discovered that many Americans, despite working, experience spikes and dips in their income and expenses that are sometimes mismatched. This mismatch, she says, especially affects hourly employees and those that rely on overtime pay.

“There’s just volatility in our financial lives,” she said. “As a result, lots of people who might be able to break even, if you looked at how much they earned over the course of a year and how much they spend over [the] course of the year [they] might be fine, but [then] this month, they’re short.”

Schneider called it a “$2,500 problem,” suggesting that many workers can be short between $500 and $5,000 during a “life-changing moment,” like a car accident, medical emergency, urgent home repair, or other unexpected events.

Schneider, in her research, learned that as often as these moments occurred in the lives of working people, others stepped up to help.

“We give a lot of money to individuals, through our churches, through our synagogues, through charitable organizations,” she said. “The workplace was a good place to go explore that, because there are not that many communities that are as socioeconomically diverse as workplaces. So there’s really a chance to connect people who have differing financial needs.”

What exists at companies, she explains, is a hodgepodge of solutions to meet the needs of employees who are in dire need of extra money: a payday advance or a loan against future paychecks, a GoFundMe fundraiser or a pass-the-hat moment in a meeting or break room; Schneider also pointed to collection jars at cash registers or other customer-facing points in some companies.

Employee relief funds. Large companies like Walmart, Home Depot, and Levi’s have developed their own in-house employee relief funds to support employees, according to Canary’s head of marketing, Catherine Scagnelli.

“Major retailers, major manufacturers in the US, many of them have something in place like this, whether they run it themselves or they outsource it,” Schneider said. “It’s hard for a smaller organization to set up the infrastructure to make it seamless and easy for them.”

Canary aims to offer a platform for employees of small- and mid-sized companies to access these types of resources (although both Scagnelli and Schneider pointed out that large companies like OceanSpray, Visionworks, and Clear Channel Outdoor also use the platform, and Uber has run a pilot program with Canary).

Canary currently works with 43 companies and has awarded nearly $6 million in grants since beginning operations.

“HR leaders in mid-sized companies,” Schneider said, “they are being asked to do so many things at once…I wanted for this to be available to anyone. And the majority of American workers do not work at large firms. So that means you need a small company and a mid-sized company solution.”

The Canary platform is easy to use, optimized for web, mobile, or tablet, with an application that takes about 20 minutes to complete. With streamlined criteria, Scagnelli said Canary’s team is able to approve, deny, or request additional information within 48 hours.

There’s a fee to set up the program, and each company seeds their employee relief fund, with the help of Canary’s team to guide HR leaders through this process, additionally offering insights about the program’s use and needs. Funds can be set up to exist as an ongoing resource, or be set up as a one-time solution for something like a natural disaster.

“We provide data back to the employer that is totally anonymized, so they can see what issues their employees are going through,” Scagnelli said. “It can help them identify other gaps and benefits that could help without having to know the personal stories, and it takes away the sense of judgment that we can have about people in their financial situations, too.”