This podcast episode and transcript originally appeared on finhealthnetwork.org.

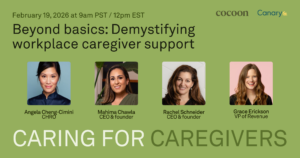

Canary Founder and CEO, Rachel Schneider recently joined Jennifer Tescher, President and CEO of the Financial Health Network, to talk about her work to examine the financial lives and challenges of Americans in the book, The Financial Diaries: How American Families Cope in a World of Uncertainty, and how it inspired Canary. Listen to their conversation to learn more about financial strains of American workers and how a platform for employee assistance grants can help those workers in times of financial hardship.

Read the transcript & learn about the financial hardships of Americans that inspired Canary’s employee assistance fund

Jennifer Tescher:

My guest today, Rachel Schneider, is steeped in the work of financial health, having literally written the book on the financial lives of Americans entitled “The Financial Diaries.” The insights from the seminal research she conducted with co-author Jonathan Morduch ultimately led her to launch her latest endeavor, Canary, a technology solution to help employers make emergency funds available to their workers during moments of financial challenge. Rachel is now practicing what she has been preaching to other innovators: Successful businesses are informed by a deep understanding of how people live their lives.

Rachel, welcome to EMERGE Everywhere.

Rachel Schneider:

Thanks. I’m so delighted to be here.

Jennifer Tescher:

This is really a lot of fun. We have known each other a very long time now. But I have you on not because you’re my friend, but because you are also the CEO and co-founder of a very cool startup called Canary. Tell our listeners. What is Canary?

Rachel Schneider:

Well, thank you so much. It is really fun to have this conversation. So Canary is a startup that makes it really easy to sponsor an emergency relief fund. So you could use it in any community. Where we’re really starting is with employers. So a obvious use case is one of our clients is in the Pacific Northwest, and they were thinking about how to professionalize their response to wildfires, right? That’s just a fact of doing business now for them is that on an annual basis, they’re going to have employees who are really impacted by living where they live and the increasing rate of natural disasters. And they wanted to be able to have something really clear to say to their employees about, “Yes, we have your back.” They also wanted to take pressure off of HR leaders and managers who otherwise are trying to come up one off with solutions for people. And there’s some sort of not terribly well understood IRS rules around paying tax advantage payments. Essentially you can give people additional money without it being considered taxable income. If they’re experiencing either a natural disaster or importantly, a personal hardship, right? Which operates in somebody’s life very much the same way as a natural disaster.

So Canary really exists to make sure that all employers take advantage of those IRS rules and make it more common and ubiquitous really to have emergency payments be part of the financial wellness infrastructure in the U.S.

Jennifer Tescher:

So why Canary? Where does the name Canary come from?

Rachel Schneider:

Why do we name it that? Yeah, it’s so funny. So we really were thinking about the Canary in a coal mine. Of course the idea of the Canary in the Coal Mine is that it’s a system that keeps everybody safe. Right? And you could think of your ability to be able to manage through an emergency as the Canary in the Coal Mine of financial health more broadly, right? If people are financially stable and generally healthy, then when a disruption occurs, it doesn’t become an emergency. It’s just a disruption. Right?

So everybody’s car breaks down. But for some people, that car breaking down is actually a really big deal. Right? So that’s why we were thinking about the idea of the Canary. That having an emergency fund in place is really a way that an innovative technology, which at the time, when we first started using canaries and coal mines, it was an innovative idea, right? It’s this idea of a system that keeps everybody safe.

Jennifer Tescher:

Got it. And what has the response been from employers? How far along are you?

Rachel Schneider:

So we are very early. But that doesn’t mean this idea isn’t further along. So part of the rest of this origin story of how I landed here is, and I’m sure we’ll talk about this research. But when I was at the Financial Health Network, I had the chance to do this extraordinary research project called the U.S. Financial Diaries. And after that, at the tail end of that research, I was doing a lot of public speaking. And one of the rooms I had spoken was a large employer. And I was talking about this need for emergency funds. And this employer said to me, “We do that.” And it was complete news to me. So it turns out this idea of emergency relief funds being sponsored by an employer is actually far more common than most people realize. So Starbucks, Home Depot, Wells Fargo, Target, Best Buy. They all have funds like this in place. Large enterprises increasingly do.

What’s less common is for smaller employers to have this in place. So our job really at Canary is to make this idea ubiquitous throughout the employer landscape, to build on the momentum that’s already there. So the idea has a lot of traction. Canary is very early days, right? So we have our first handful of clients that prove to the world that we can deliver this service. And our service is distinguished in the marketplace by a number of things. One is a heavy reliance on technology so that we can cost effectively serve employers of all sizes. The other, which won’t be any surprise to you or your listeners is a real reliance on financial health as a concept, right?

So we do impact measurement. A lot of reporting back to employers about how their employees are faring after are receiving a grant. We do a lot of wanting to understand the true financial health and wellbeing of somebody as part of understanding should they get a grant or not? And also we have an extraordinary commitment to customer service. So there’s room here in this market for us as a new player to make this a much more commonly understood, commonly used idea.

Jennifer Tescher:

Well, this is all music to my ears. And we are definitely going to talk about the Financial Diaries work. But I want to stick on Canary for just one more moment. I wonder if you can tell us either the story of a particular individual from one of your clients, or if you can share sort of more general data that helps us understand what a typical scenario looks like, how much money are we talking about? This is grant money, if I understand it, right? It doesn’t need to be repaid. Tell us a little bit about what you’re learning from the end users.

Rachel Schneider:

Yeah. So much. So it is helpful to put it in stories. We have one client who whenever I hear him talk about why he implemented Canary for his company, he always goes to this one story. So I’m going to go to this story too in deference to him. It’s a home healthcare company. So the staff are sitting in other people’s homes, taking care of either elderly or ill people. And there was one employee who was experiencing a financial crisis that was causing her just a lot of stress. And was making it so that she was just not sure if she’d be able to pay for her rent. She was worried she was going to get evicted, frankly.

And through Canary, she was able to receive a grant of $1,000. And she was pregnant at the time and experiencing preeclampsia, which is hypertension. And she really describes it as like, “But for this grant, that pregnancy would have been in danger,” right? Her feeling about this grant was not only did it keep me housed and keep me buying groceries from my kids, but I was otherwise going to experience really meaningful, personal and health consequences from the level of stress that I was feeling. Right?

And I think that sort of broad understanding of how financial stress plays into the other things in people’s lives is a big part of what we hear and see. Right? So many companies are worried right now about the mental health of their employees. Totally fair. We have a massive mental health crisis. Mental health is often intertwined with financial health. So you can’t always solve one without the other.

So we see that in our data and in the stories we hear from people, we also see a lot of appreciation for an employer who is going to put a fund like this in place. So one of the things we’re looking at is how do people feel about their community?

So one one thing I didn’t mention is that the way grants, which yeah, we don’t expect the money to be repaid. The way that grant funds are raised for this purpose are a combination of things. One, usually companies write a check themselves. Two, they often do fundraising campaigns internally. So employees are contributing to the wellbeing of their colleagues, but in an anonymous aggregated way, right? It’s this is my community. I want there to be money in it for our community. Sometimes, companies are fundraising from their customers or from their investors. So that feeling of we’re all in it together also really generates value for people. So even if you are never the person who requests a grant, you know you’re part of a community where this exists, that sense of common purpose exists. And we do see that as having meaning, and it shows up in how people talk about their pride in being part of a company that implemented something like this.

Jennifer Tescher:

That’s really interesting. And particularly now, I mean even before COVID, the sort of nature of work, there was a lot of hand-wringing about that. But now, well I shouldn’t say post-COVID, but two years into COVID.

Rachel Schneider:

Hopefully post-COVID. Right?

Jennifer Tescher:

But I want to hope, but I don’t want to jinx it. Two years in. Huge questions about role of work, way we work. So this notion that you think, and you are seeing that there is still a sense of community to be built at one’s place of work, which isn’t really a place anymore necessarily.

Rachel Schneider:

Right. Right.

Jennifer Tescher:

Is really interesting to me. And so I’d love to hear you talk a little bit about that. How does this kind of concept work in a sort of a future of work world? And also, the question of why is this the employer’s responsibility in the first place?

Rachel Schneider:

Yeah. Yeah. I’m so glad that that’s where your brain went with this. And I think those are really related, right? So I do think it’s the employer’s responsibility to create a sense of community. People want to have a sense of belonging at work. And that shows up, the idea of belonging shows up in why people are so, one of the many reasons why people are appropriately focused on DEI issues, right? People need to feel that they can bring their whole self to work, whatever that means, right? It actually mean all of your messiness necessarily, but people need to be able to bring enough of themselves at work to feel authentic. Some of that is sharing the ups and downs of your life. And if people don’t feel that they know each other, aren’t invested in each other’s lives in some way other than did you finish that part of the project that I need you to finish so I can finish my part? Then they just aren’t going to have that sense of belonging and care amongst each other at work.

And I think it’s much harder to create that than it was when you expected to show up at the same job for 20 years in a row nine to five. Right? Much harder with people being in and out jobs in a shorter period of time, working remotely.

Jennifer Tescher:

As we both do this from our home offices.

Rachel Schneider:

Yeah, exactly. Right? It’s really hard to feel connected to your remote colleagues. So I do think programs like Canary’s are an important on-ramp into acknowledging hey, we are in each others’ lives.

The other thing I’d say about that is that one way to see what Canary does is to see us as formalizing something that always happens informally, right? People do help each other period. People step in. If you have a colleague, and the origin story for a lot of companies who have an emergency fund in place is there was a person who worked here who was beloved, who experienced X, and it was really bad. And we all took a collection for that person. And we helped her. And then somebody said, “Hey, shouldn’t that exist for everyone and not just for somebody who’s really senior, or really well liked, or really well known?” And I think it’s really powerful to do that kind of communal giving and sharing in a heterogeneous community like a workplace, where people have different levels of financial resources, right?

So usually, there’s a huge amount of giving and sharing of financial resources in any community, but communities tend to be homogeneous. So the financial capacity of any community to help each other is limited by the financial capacity of that community. Workplaces are one of the few places where you’re jumbled together.

When I first started working on this idea, it was pre-COVID. So there was still a lot of public speaking and meeting people you didn’t know already. And whenever I would talk about this idea, people would say, “Well, my church does that. My synagogue does that. My fill in the blank. I’m part of the board at the YMCA. We do that.” Right?

So communities do have emergency funds for each other. They all do. What Canary is doing is when we were first looking at this idea, we were thinking about it as emergency funds are ubiquitous in our society. You can find them in all sorts of places. They’re just very spotty and inconsistent. And what one person said to me is you need to be a systems ninja to be able to navigate the world, to find emergency funds. But who in the heart of experiencing an emergency is a systems ninja? Nobody is. The paperwork need, the research need. How do I find who has an emergency fund for me?

So for employers to step in and be, they’re already a place where people expect to go to look for benefits of some kind, to look for help of some kind. To be a clearing house for this kind of help also makes a lot of sense.

Jennifer Tescher:

So one of the many reasons why I am such a fan of this idea is that not only are you a former Financial Health Networker, or actually you were there when it was still the Center for Financial Services Innovation. But if I’m not mistaken, the entire team are all former FHNers. Or CFSIers, as the case may be.

So gosh, I don’t even remember when you originally joined our organization because feels like you were always a part of it. You worked with us as a contractor for many years prior to joining us full-time. But in many ways, the project … project is too small a word. The body of research that you helped to birth, the Financial Diaries really went on to be an incredibly influential and meaningful set of findings that I think have changed a lot about the understanding we have of people’s financial lives. So I know that your work on that project, on that research influenced your thinking around Canary. I’d like you to go back to the research itself. Describe to people what it was, what’d you learn from it, and then how’d you get to Canary from there?

Rachel Schneider:

So the diaries was a deep dive into the financial lives of working families in the U.S. We worked with 235 households. They were in 10 distinct communities. So it was not with that number of households, a statistically significant number of people to say well, this is what it looks like to be a working person in America. But the 10 communities were distinctly different in a way that we did feel actually that we can understand what it’s like to be a working person in America. Right? So it was an immigrant community from Bangladesh in Queens. It was an immigrant community from Latin America and California. An African American community in Mississippi, a community in Ohio. So people who were urban, suburban, rural, had lived in the U.S. for generations, had just gotten here, right? The one commonality was that every household had somebody in it who worked. So we were looking to understand families who were struggling, but not families who were not generating any income on their own. And the income distribution of the families was really from above the poverty line to the median income of their area. So really working class people.

Jennifer Tescher:

And put us in history now, because it’s been a while. What was the time period of the data gathering?

Rachel Schneider:

Yeah, so interesting. Right? So we were gathering data in 2012 through 2014. And the reason I say oh, so interesting was because the motivation for the research was let’s do a deep dive that transcends economic cycles, right? So the planning for the research was after the recession and the crisis of 2008, 2009. And the motivation was very much okay. We had this housing crisis, and it unearthed this incredible financial fragility that people clearly had been experiencing all along that had been masked by rising debt loads, rising house prices. Right? So how do we miss it? How do we not know there was this fragility underneath? Let’s do a very deep dive that can transcend cycle. So I think that’s a big, that insight by the people who thought we should do this research, where our funders at Ford and Citi. Was really powerful because they just knew we need something that has shelf life.

Jennifer Tescher:

And Omidyar.

Rachel Schneider:

Exactly. I was going to, right exactly. And what Omidyar brought there also was okay, don’t wait. This was a long research project. We spent seven years on it. And thank God for patient funders. Frank DeGiovanni and Brandi McHale, amazing. Amazing. Who has patience for seven years of a project. Right? Yeah. And Omidyar was like, “That’s good. And also, could you publish some things tomorrow because it’ll be useful tomorrow.”

And that was exactly right. So it was really philanthropic funding at its best in my view. We had all the versions of it. And we were replicating work that had been done globally, but with a real understanding that you needed a U.S. partner. So for those of who don’t know the origin of the story of this research who are listening to the podcast, I was just incredibly lucky to be sitting in the seat. Right? The funders came to what was then CFSI and said, “You should be the U.S. funder. I mean, the U.S. partner. bring your knowledge, your expertise, your amplification powers.”

Jennifer Tescher:

Right. And that was to partner with folks like Jonathan Morduch at NYU, close colleague and friend who had been doing work like this overseas. And Darrell Collins who had really helped to pioneer this kind of research also in developing countries overseas. So we definitely were in the right place at the right time.

Rachel Schneider:

Yeah. It was great. It was so lucky. And really, yeah. I think one of the things that’s powerful about it was this combination also of stories and data. Right? So not only of some of the insights from that research proved to have longevity, but the acknowledgement that if you really want to understand anything, you got to go hear in people’s words, in their own words, and collect data.

Jennifer Tescher:

So what was the big takeaway, the top two or three takeaways as it relates to cashflow? What were the new insights gleaned?

Rachel Schneider:

Yeah. The biggest one that we talked about a lot was the idea of volatility within a year. So there had been a lot of research about, and this is what an income statement approach gets you. Right? That something like I won’t remember the statistic now. Something like an extraordinary percentage of families, 25% of families have income swings of more or less than 25% from one year to another. Driven by big things like changing jobs or changes in household structure.

What we could see in the diaries was that actually those swings also existed month over month. So in any given month, you might earn 25% more or less than you had earned the prior month. That’s a lot of volatility to manage. And we used 25% as an important benchmark because the year-over-year work had been structured that way. But actually, what we saw were income swings and expense swings of 50% or more. And we saw them in almost half the months.

So the idea of well, this is my standard month. It goes right out the window. And I think for those of us who have spent our professional lives and salaried jobs, this is super surprising. Right? But really, what it reflects is that if you work in an hourly job of any sort, you’re going to have fluctuations in what you earn this week to next week based on how many hours you get at work. And a huge portion of our country lives that way. So really, we were documenting those swings. That was a huge part of the work, and changes entirely how you think about financial education, how you think about borrowing, how you think about savings, right?

Jennifer Tescher:

Even just the myth that expenses, most expenses are fixed. I think most people are taught that 80% of your expenses, your rent, your light bill are fixed. But I think the diaries research found that it was only 20% of expenses on a monthly basis are fixed.

Rachel Schneider:

Exactly. Even though, they should be fixed maybe. Your rent should be the same every month. But what we saw was that people knew you couldn’t get evicted, so they didn’t pay their rent every month. Right? If they had an income swing, all of a sudden rent’s no longer fixed. And there’s been some great research particularly coming out of JPMorgan Chase Institute about how medical expense is not fixed. Right? People pay them when they have the cash, not when they get sick. So I think that was surprising. Right? And when you think about how to tell somebody how to budget, that’s surprising.

Jennifer Tescher:

Yeah. So talk a little bit about what this data, what these insights did in the world. How did it change things?

Rachel Schneider:

Well, I take a deep breath on that one. I mean I hope they changed things. One thing I know they did for example is inspire other research. So even though we had this very deep dive, it’s not a massive data set the way for example JPMorgan Chase is. So we were the first to write about income volatility in this way. So they went and looked at it with their bigger data set and confirmed everything we had. Similarly, the fed and the FDIC started asking questions about volatility. So it really put this issue on people’s radar screen.

The fun thing for me is that I regularly hear from fintech startup types, that this has been really influential to them. And this also, it’s largely the result of where we sat when we did the research. But because we were sitting at the Financial Health Network, we were really in position to put these findings in front of people who would take action. And that was the primary goal. So to go out and do speaking, when you write a book, you hope people will ask you to come talk about that book. Right? So, because of who the Financial Health Network is, well we got asked to go talk about the book, it was at places like PayPal. And at big banks, right? And big employers. So for them to hear well, this is how your employees live, or this is how your customers live. I know inspired a lot of really interesting product work, a lot of really interesting thinking in HR departments. And that was really gratifying for us. And that was the goal is that people would take up our definition of the problem and start creating their own ideas of the solutions.

Jennifer Tescher:

You have been entrepreneurial in a whole host of ways throughout your career. At one point, you were an investment banker at Merrill Lynch. But I know you, and I know that you’ve always been concerned about these issues. What do you think has driven you to focus on the financial lives of lower income Americans?

Rachel Schneider:

Yeah. I wish I had a better answer, but it’s a vague one. I just always wanted to do work that I felt had meaning, right? We I think all feel that way in different ways. I wanted to do work that was helpful in some way. And I grew up in a way that was pretty easy, right? This isn’t a well I grew up in hardship, so I wanted to help other people in hardship story. But I grew up in a way that was easy and very aware of the luckiness of our ease. Very aware of the hard work that had gone into it, and very aware of the ways in which hard work and luck bundled together to drive outcomes.

So I was focused on economic inequality from an early age. I think it’s nice of you to describe me as entrepreneurial. I see it as less entrepreneurial and more that I like change, and I have a high tolerance for risk. So I chose to be an investment banker, because it sounded like it’d be hard and I’d learn stuff, but then I didn’t actually care that much about the outcomes of our work. So I made a change and went and worked with you at the Financial Health Network where I really cared about the outcomes of the work. And then what happened, and this goes back something you were asking about earlier. I got to a stage where personally I felt like okay, I get it. I understand a lot of the problems here. And I’ve been telling other people how I think they should solve them. And personally, I just want a different seat. I want to go see if I can solve some problems too.

And that’s really how I ended up getting to work with some of our shared former colleagues, because I had some colleagues who were in a similar boat. So Kimberly Gartner, who was also an original CFSIer. Was also in a moment in her career where she felt like yeah, I want to build something new. And she’s a really talented business development executive. So she came on to forge all of our early employer relationships. And Aliza Gutman who actually had done the very first financial health study at Financial Health Network wanted to be a builder of products. And it had parts of the jobs of building products in other jobs at PayPal and at Charles Schwab, but wanted to be head of products somewhere. Right?

So we were all in this mode of we want these new professional opportunities. And well, I’ve never heard this parallel in my mind before. But I actually think we’re almost like, if we want these opportunities, we’re going to have to make them ourselves. Nobody’s going to hire us for this job. Nobody was going to give me the job of CEO of a fintech firm. If I wanted that job, I was going to have to found it first.

Jennifer Tescher:

And I go back to the word entrepreneurship.

Rachel Schneider:

Oh yeah. Well then I got there. But yeah, but I do think of it as willingness to suffer. And I wanted to feel like a beginner again. I think I’m pretty far along in my career. I really like learning. I wanted to feel like I was learning stuff again.

Jennifer Tescher:

And we shouldn’t forget about your newest staffer.

Rachel Schneider:

Go Catherine. Yay. I know. We hired Catherine Scagnelli who had been in marketing at Financial Health Network. And it’s just awesome. It’s so fun. And I don’t want to underplay, we do have other staff people. We have hired many other people not from the Financial Health Network, but that network has continued to really be powerful for me. I mean, our advisors, our investors, our just cheerleaders, they’re all people that I know in some ways from Financial Health Network. Almost everyone.

Jennifer Tescher:

When folks come to work with us and then move on to the next thing, we always say you’re not really going somewhere else. You’re just taking us with you to a new location. And I would say for a majority of the people for whom we’ve been part of their journey, I think that’s true. And it’s maybe one of the things I’m most proud of to be honest. And I think the world is the better for it, because people are out there like you, and your colleagues, and others who are building and inventing totally awesome new things that are based on the learnings and the knowledge we have about people’s real financial lives. So I find it to be very gratifying.

Rachel Schneider:

I’m glad. I’m glad. You should, because it really is a community. And it’s an alumni group that feels really warmly about each other, and about our time at Financial Health Network, and about the work that we’re building. Right? So I find it really powerful. And it’s not only those of us who are employed at the Financial Health Network are CFSIers. One of our latest clients is an early, early CFSI very active company. And that’s so fun. Right? And it does feel like we’re just we’re just bringing the whole team back together.

Jennifer Tescher:

That’s great.

Rachel Schneider:

So yeah, it’s really good.

Jennifer Tescher:

So a big part of this story is really about leadership. So we talked about whether or not you’re an entrepreneur. But you are a leader. And I wonder as you think about this kind of work, what does it take to be a successful leader in doing it?

Rachel Schneider:

Yeah. So this is going to sound, there’s no way for this not to sound ridiculous sitting on your podcast. But really Jennifer, you’ve been an incredible leader in this space. No, I’m going there.

Jennifer Tescher:

That can’t be your answer.

Rachel Schneider:

It can be. I know. I knew you would say that. That’s why I’m like, “This is going to sound ridiculous.” So for those of you who are listening, Jennifer was my boss for a long time. And I had a bear hard time with leadership in lots of ways. The idea that people would need direction didn’t come obviously to me. Anyways, Jennifer would say something that I’d now repeat to others. She says leadership is repetition. I don’t know if you still say that or if you only said that to me.

Jennifer Tescher:

I said that just as a reminder to myself.

Rachel Schneider:

Yeah. You used to tell me leadership is repetition, because I was like, “But didn’t we already talk about X thing already? And why are we talking about that in another staff meeting?” But that idea really sticks with me. I do think leadership is repetition. I do think that people value, it’s not enough to have the idea. I think of that as related to the idea that ideas are cheap. Execution is what matters. Right? So it’s one thing to have the idea at first, but then to stay focused on an idea for an extended period of time, keep repeating it, keep iterating on it, keep finding new ways to make it interesting to people. I do think that’s a really powerful element of leadership. And it is one Jennifer, and I’m practicing you’re good at, right? But I do think that’s a more general skill, right? I’m sure we could come up with plenty people in this community who have that sort of staying power, that commitment to the long-term goal.

Jennifer Tescher:

So lest you try to praise me any further and to bring this podcast to a close. So in addition to the diaries book that you and Jonathan Morduch authored, for someone else who may be newer to this work and who’s really looking to dive deep on people’s real financial lives. What other books out there would you recommend?

Rachel Schneider:

Yeah. You have to read Scarcity. If you’re going to do work in this space, you just actually have to read Scarcity. Behavioral economics insights, that sort of also transcend economic cycle. And there’s other books in that ilk you could read, but I feel like Scarcity is the one I keep coming back to over and over. The other book that is a go too for lots of people is clearly Evicted. And I found it really hard to read. It’s so painful. But if you want to dive into where people really are hurting and feel empathy for the ways in which people’s financial life just cause this pain. I think that’s also a really valuable read.

Jennifer Tescher:

I’m glad you ended on empathy, because I think that’s probably a key characteristic for folks who want to do this work. And you have it in spades. So Rachel, thank you so much for joining me on EMERGE Everywhere.

Rachel Schneider:

Thanks so much for having me. It was an absolute pleasure.