Corporate-sponsored relief funds offer an immediate lifeline, filling the gap for those employees facing financial crises right now, according to Canary CEO Rachel Schneider. This piece originally ran in Benefits Pro on October 24, 2024 and was written by Lynn Cavanaugh.

Many Americans are drastically unprepared for a financial emergency. However, there’s a critical, often overlooked piece to this particular employee well-being puzzle: emergency relief funds. While savings are vital, the reality is that many employees can’t afford to save or save fast enough to be ready when an emergency strikes.

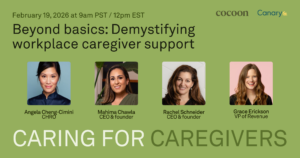

Corporate-sponsored relief funds, like those available at Canary, offer an immediate lifeline, filling the gap for those employees facing financial crises right now. We talked with Canary founder and CEO Rachel Schneider, who discusses how her company is at the forefront of modernizing financial preparedness solution to scale for organizations of any size to help employers provide direct financial relief to workers when savings aren’t an option.

Q: What is the importance of emergency savings in the workplace?

A: Emergency savings are a vital part of any employee financial well-being strategy. When employees have a cushion to fall back on, they can handle unexpected expenses — a medical bill, car repair, or sudden income disruption, for example — without resorting to high-interest loans or credit card debt. Despite the clear benefits, the reality is that many employees — especially lower-wage workers — are unable to build these savings quickly enough (or at all) to prepare for an emergency sufficiently. That’s where we see a critical gap in what companies offer today.

Q: Why are emergency relief funds often overlooked?

A: Many organizations informally offer financial help to employees when they’re struggling—direct donations from leadership, pass-the-hat fundraisers, or circulating GoFundMes—but they don’t know that a company like Canary will formalize a more equitable approach to workplace giving across their employee population. Some larger companies offer internal emergency relief fund programs, but the costs, both financial and in team time, are high and don’t offer the speed and anonymity of 3rd-party program management that employees find so beneficial.

Q: Can small employers afford to offer corporate-sponsored relief funds?

A Yes, and it’s best done through a 3rd-party program with an existing 501c(3) charity, processes, and an expert team in place. At Canary, we’ve intentionally designed our platform to be scalable and flexible so that organizations of any size can offer this important support to their employees. We also work with large businesses, but considering how much of the workforce is employed by small- to-mid-size businesses, it was important to us to create a structured, efficient way to provide support during emergencies that’s feasible no matter how large your company.

Q: How is Canary modernizing emergency relief funds to scale or organizations of any size?

A: We combine the latest technology, payment innovations, and human touch to give employees at any organization their fastest path to financial relief in times of crisis. To make this scalable for any organization, we’ve built a solution that handles the heavy lifting, from fund setup to request management and fund disbursement. This allows companies to offer immediate, direct support without building complex internal systems or dedicating significant internal resources to program management. We also work to tailor programs to each client, ensuring they align with their culture, values, and their unique employee needs. Our focus on flexibility means companies can set their guidelines, contribution levels, and eligibility criteria, making relief funds a seamless addition to any benefits package.

Q: Are corporate-sponsored relief funds a better solution than emergency saving account or pension-linked emergency savings?

A: It’s not that one is better than the other, but that they are designed for different situations. They are both common sense additions to a company’s financial wellness strategy, and they work best together. ESAs and pension-linked savings help employees build financial resilience over time, which is critical for long-term financial health. Meanwhile, corporate-sponsored relief funds address the immediate need for financial assistance when an employee faces a crisis and doesn’t have enough savings to cover it. This immediate relief sends a strong message of caring in a crucial moment, enabling the individual to get back on their feet. It can be a powerful way to build a culture of caring and drive loyalty within a company.

Q: Are more and more employers stepping up to provide employees with a financial safety net?

A: Yes, employers increasingly recognize the importance of providing a financial safety net for their employees. The challenges brought on by the pandemic, rising living costs, and economic uncertainty have pushed financial well-being to the top of the priority list. Employers understand that when their employees struggle financially, it affects every aspect of their lives — including their performance and engagement at work.

The truth is, there’s a crowded field of options and no one-size-fits-all approach. While we’re seeing a growing number of companies embrace solutions like emergency relief funds as part of their broader strategy, many companies (and their benefits and HR teams) still don’t know that 3rd-party employee relief fund solutions exist. It’s become clear that this type of direct financial assistance isn’t just a compassionate act that solves a real issue affecting almost everyone’s workforce; it’s a strategic investment in building a resilient, loyal, and productive workforce.

Contact our team today to learn more about supporting your employees through financial hardships. In the meantime, download our most recent Impact Report to learn how employee relief funds support modern, diverse workforces in uncertain times.